eBay CEO Jamie Iannone Regrets Support For American Rescue Plan

In an interestingly timed op-ed in Fortune, eBay CEO Jamie Iannone expresses regret for supporting the American Rescue Plan and lobbies for increasing the 1099-K reporting threshold again.

The vast majority of Americans selling online are not running businesses, but rather are casual sellers who occasionally sell used or pre-owned goods to make a little extra money. These individuals’ sales online have typically been below the threshold that would trigger a notification to the Internal Revenue Service (IRS), which means they did not receive a 1099-K tax form–until now.

Section 9674 of the American Rescue Plan Act of 2021 included a last-minute provision that drastically reduced that threshold, imposing a significant administrative burden that could jeopardize access to these marketplaces for millions of Americans.

As the CEO of eBay, I supported the American Rescue Plan, which provided economic relief for American workers and businesses impacted by the COVID-19 pandemic. However, the lowering of the 1099-K threshold from $20,000 in annual payments (and 200 transactions) to just $600 does the opposite of the legislation’s intended goals and will cause confusion, increased cost, and tax overreporting for those Americans who need the extra income the most.

While Jamie carefully frames this issue as concern about the impact to smaller sellers, many sellers are skeptical of eBay's motives and believe it's more about the increased cost of compliance and loss of active sellers eBay faces as a result of the lower 1099-K threshold.

As one seller in the eBay community put it:

The real impact of this law is not on us as taxpayers---we are supposed to report income whether we sell $600 or $20,000 on here (or any other amount).

The real impact is that ebay will have to spend a fair bit of money to comply with the requirement that they send out these documents to millions of sellers, and that means the impact will be felt on us as sellers---ebay will pass the cost onto us one way or another, and we can try to pass it on to our buyers, but make no mistake, ebay will not be paying for this, we will.

Iannone's message continues:

As many Americans find their paycheck doesn’t stretch as far these days, they are turning to the re-commerce market to supplement their income. This is particularly true for women, who have shouldered a lion’s share of the pandemic’s economic burden. The small amount of money earned from cleaning out a closet or garage can ensure the utility bill is paid or there is food on the table.

A survey of e-commerce sellers that had less than $20,000 in online sales last year found nearly half are selling online to pay for necessary personal expenses such as medicine, housing, and clothing. The new reporting threshold could put that in jeopardy.

Funny how he doesn't mention new/casual sellers (most likely to be "emergency selling" to pay bills) face holds on funds that can last weeks past the sale date - meaning that small amount of money earned from cleaning out the closest or garage is not going to be available to help with immediate needs like paying utilities or buying groceries.

Over the years, filing taxes has grown increasingly complicated, confusing, and expensive–taxpayers spend tens of billions of dollars each year on software and other filing expenses. The new reporting requirement checks off all those boxes for casual online sellers who will be surprised to find they may receive an IRS 1099-K form come the next tax season. While the IRS considers the sale of second-hand goods for less than the original purchase price to be non-taxable income, casual sellers would have the burden to prove to the IRS that they earned no taxable income from those sales. And, if they don’t have proof of the original price, then they could be liable for income tax on those sales.

Most casual sellers are unlikely to have the original receipt from the old bike, stroller, or gently used shoes they sold online, and it’s unreasonable to require such proof given the small transactions involved. Many will decide they need to hire a tax expert while others will simply overreport their income to be on the safe side–wasting money that could have a real impact on household budgets.

Really Jamie?! You're going to talk about it being unreasonable to require casual sellers to keep receipts for taxes when eBay regularly suspends sellers for not being able to produce receipts in those same exact circumstances?

And while we're on the topic of spending tens of billions of dollars each year on software and other filling expenses, let's have a chat about your new BFF, Intuit, shall we Jamie?

You know that company you're in bed with and luring sellers to use for bookkeeping is being forced to pay a $141M settlement for using dark patterns and sketchy tactics to trick mostly lower-income users into paying more to file their taxes, right?

Potential and existing sellers, daunted by the possibility of a complicated tax form, may simply refrain from participating in the marketplace altogether or even throw away those items which could be used by someone else instead of adding to our landfills.

The more budget-conscious consumers who are flocking to the re-commerce market to purchase previously owned goods will be particularly impacted by this change. Online marketplace platforms offer alternative avenues for finding much-needed items that are either more expensive elsewhere or unavailable due to persistent supply chain issues. If sellers sit on the sidelines, weary consumers will have to look elsewhere, which will make this holiday season even more difficult for many...

...eBay urges Congress to immediately raise the reporting threshold to a more reasonable figure that would maintain access to online marketplaces for all Americans without undue burdens, additional expense, or fear of making a tax misstep.

I'll give Jamie a few points for some transparency here - eBay is absolutely terrified about the amount of sellers who are taking their inventory elsewhere, especially where they can set up local exchanges for cash to avoid both eBay fees and 1099-Ks.

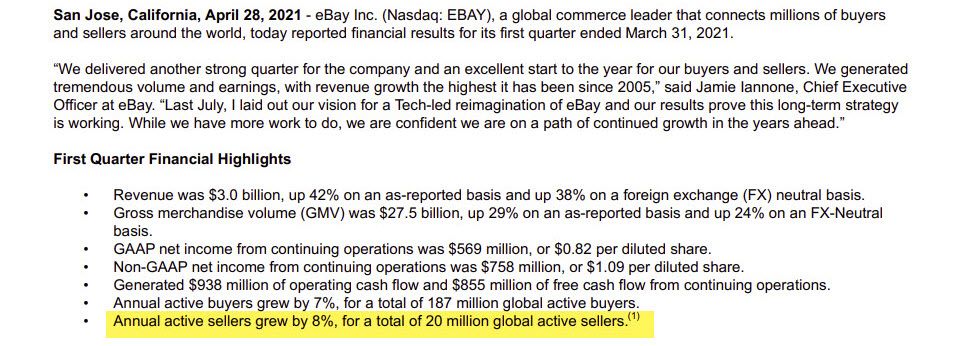

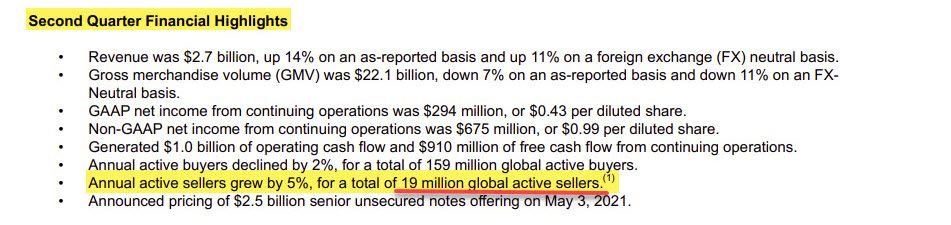

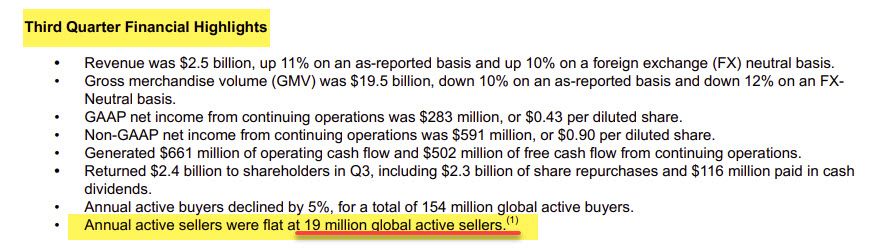

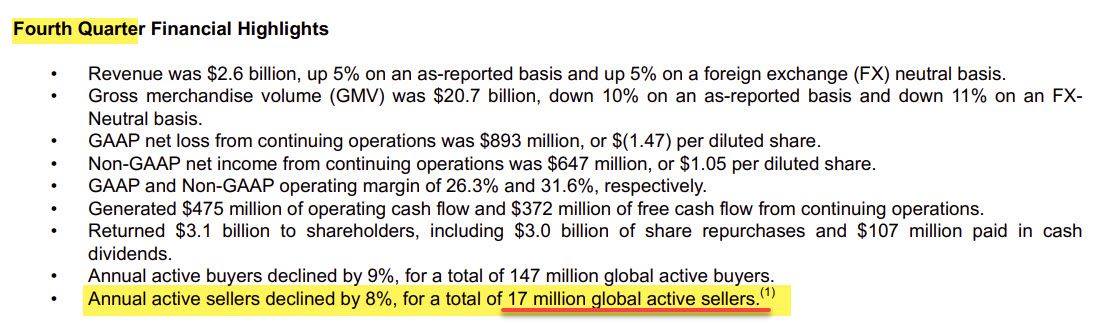

While eBay has been inconsistent in reporting active seller figures over the years, the last reported numbers from 2021 showed a troubling trend, dropping from 20 Million in Q1 2021 to 17 Million in Q4 2021.

After a considerably negative reaction from Wall Street, eBay has not reported active seller figures in quarterly reports since then, but I have to believe if it had gone back up, eBay would have been crowing about it very publicly.

Of course it's impossible to say how much of the seller attrition is due to the 1099-K threshold change.

Iannone needs to take a good hard look in the mirror at ongoing seller trust issues, lack of innovation and incentives to use the platform, his exclusionary vertical focus strategy that is leaving a vast swath of sellers behind and eBay's ever present technical misexecution if he is seriously concerned about sellers "refraining from participating in the marketplace."

If Jamie continues to refuse to engage in any serious self-reflection on these issues, maybe it's time for the board to step in and find someone who will.