Do eBay Fees Include Tax?

With eBay moving full steam ahead to accomplish their goal of having most sellers enrolled in Managed Payments in 2021, I'm seeing a lot of questions coming up about eBay including sales tax in the total for fee calculation.

When eBay first launched Managed Payments, they originally kept the Final Value Fee separate from the Payment Processing fee.

It's important to note that when the Final Value Fee was separate, it was charged on the item price + shipping, not including sales tax. Sellers still paid whatever Final Value Fee was applicable for their category and store subscription level, plus a 2.7% payment processing fee (later adding a $0.25 per item fee as well).

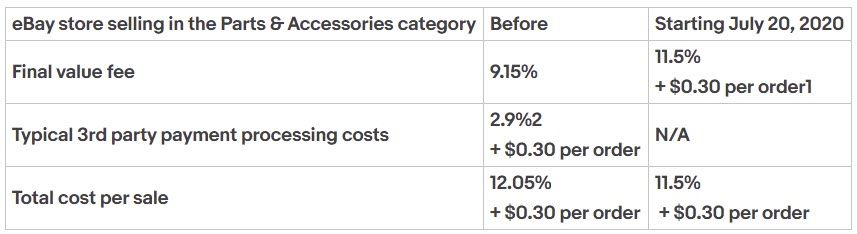

In May 2020, eBay announced the change to a new "simplified" fee structure starting July 20th, 2020. The simplified fee would be Final Value Fee and Payment Processing Fee rolled into one, plus a $0.30 per transaction fee.

At first glance that looks like a pretty obvious savings - but it's not as simple as it sounds.

In the "before" scenario, the 9.15% would have applied to item price + shipping only, excluding tax. PayPal's 2.9% payment processing fee would have been applied to item price + shipping + sales tax.

In the original announcement eBay had said the new fee would include tax starting on August 12th. This was later pushed back to September 1st. So from September 1st 2020 onward, the full simplified fee has been applied to the total order amount of item price + shipping + sales tax.

This includes all sales tax, whether it is collected and remitted by eBay as a Marketplace Facilitator or collected and remitted by the seller.

PayPal Does It Too

There's been a lot of controversy and confusion on this topic, with some sellers even questioning if it's legal for eBay to structure the fees on sales tax this way.

I am neither a legal nor tax expert and any information presented here is just my personal experience combined with publicly available information. I can't comment on the legality, but I do think it's fair to question the ethics involved.

The most common response I see when sellers raise concerns is something to the effect of "PayPal and credit card processors also charge their fees on the total including tax, so this is industry standard."

While that may be technically true, it's somewhat of a false equivalence. The percentages involved vary significantly enough that I don't think it's entirely fair to compare what eBay is doing to "industry standard."

PayPal and most credit card processing companies typically have fees in the 2-3% range on the total including sales tax.

After the recent fee increases, eBay's simplified fees generally range from 8.7% - 14.55% (there are a few exceptions, but the vast majority fall in that range.)

For some more industry standards, let's look at how other marketplaces handle fees and sales tax.

For seller fulfilled orders, Amazon does not charge any fees on Amazon collected Marketplace Facilitator taxes. If the seller has direct tax collection obligations and opts to use Amazon's tax calculation service, a 2.9% processing fee applies to the tax amount only, separate from Amazon's referral fee on the item price + shipping.

Tax Calculation Services Fees. If you use the tax calculation services, you will pay us 2.9% of all sales and use taxes and other transaction-based charges we calculate. We will retain these fees in the event of any refund on related transactions.

Etsy says if you sell from the US or Canada, sales tax is not included in the calculation for their transaction fees.

When you make a sale through Etsy.com, you will be charged a transaction fee of 5% of the price you display for each listing plus the amount you charge for shipping and gift wrapping. If you sell from the US or Canada, the transaction fee will not apply to sales tax, Goods and Services Tax ("GST"), or Harmonized Sales Tax ("HST"), unless you have included those charges in your listing price.

Mercari keeps their 10% selling fee and 2.9% + $.0.30 payment processing fees separate and apparently does not include tax in either one.

A processing fee is applied based on the item’s sold price. The processing fee doesn’t apply to separately stated taxes or shipping charges. If a seller creates a listing with multiple items, the payment processing fee is applied to the total amount of all the items sold.

It seems to me eBay is very much the exception on this - but if anyone knows of any other marketplaces or payment processors who charge similar fee percentages on total with tax, please let me know!

Cost of Compliance

Another common defense I see is that it costs money to calculate and manage sales tax collection, eBay has every right to charge fees to cover their costs, and it's better than sellers having to do it themselves.

First, this ignores the fact that most taxes collected on eBay now are eBay's legal obligation under Marketplace Facilitator tax laws. Due to the nature of these remote tax laws, many small to mid-size sellers would not meet the high thresholds for tax nexus in most states any way, so the "better than having to do it ourselves" argument doesn't really hold water.

Secondly, many states have incentives that provide credits or rebates for filing sales tax early or electronically. These incentives may allow the merchant (or marketplace) to retain a small percentage of the tax collected, which can help offset the costs of compliance.

Presumably eBay would at least be eligible for the same incentives as any seller, if not possibly even more favorable terms.

Speaking of favorable terms, eBay worked out a sweet deal to consider all sales for the state of California to have taken place in San Jose for sales tax purposes.

Under the deal, eBay would declare all taxable sales in California as made in San Jose, rather than in the location where the seller or customer is located. The assignment of all of eBay’s California sales to San Jose means the city will receive the full 1 percent increment of the state’s 7.25 percent sales tax instead of dividing those dollars among local governments based on where a sale happened.

The city would keep the first $5 million in local taxes from California sales made through the marketplace platform , and pay eBay 30% of the increased revenue above $5 million in taxes collected on transactions.

This deal was estimated to be worth about $150 million to eBay, which I'm sure helps take a little sting out of the burden and cost of compliance.

Where Does The Money Go Exactly?

When PayPal was processing the payments, the full amount including tax was processed and paid directly to the seller, then any eBay collected Marketplace Facilitator tax was deducted from the seller's PayPal account and sent to eBay.

This is the explanation for why PayPal or other payment processors assess fees on the total including tax - it's based on the total amount of money actually being processed and paid to the seller.

Many sellers assumed that Managed Payments worked the same way, but what if it doesn't? Would eBay's ethical and/or legal obligations change if in fact that tax money is never actually paid to the seller?

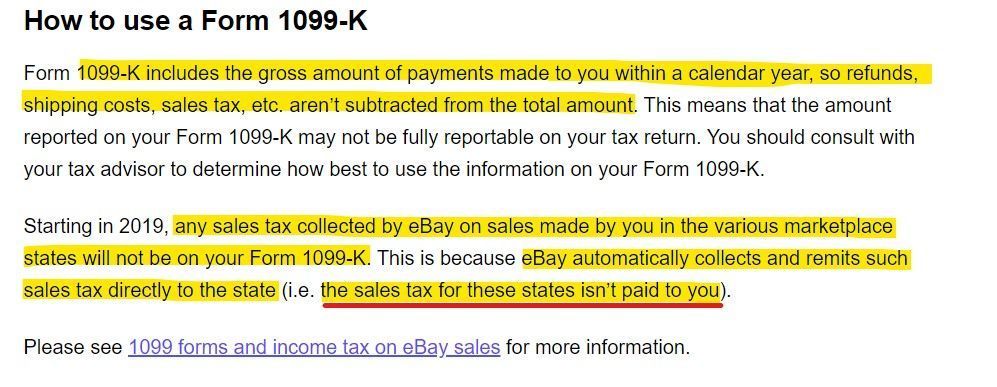

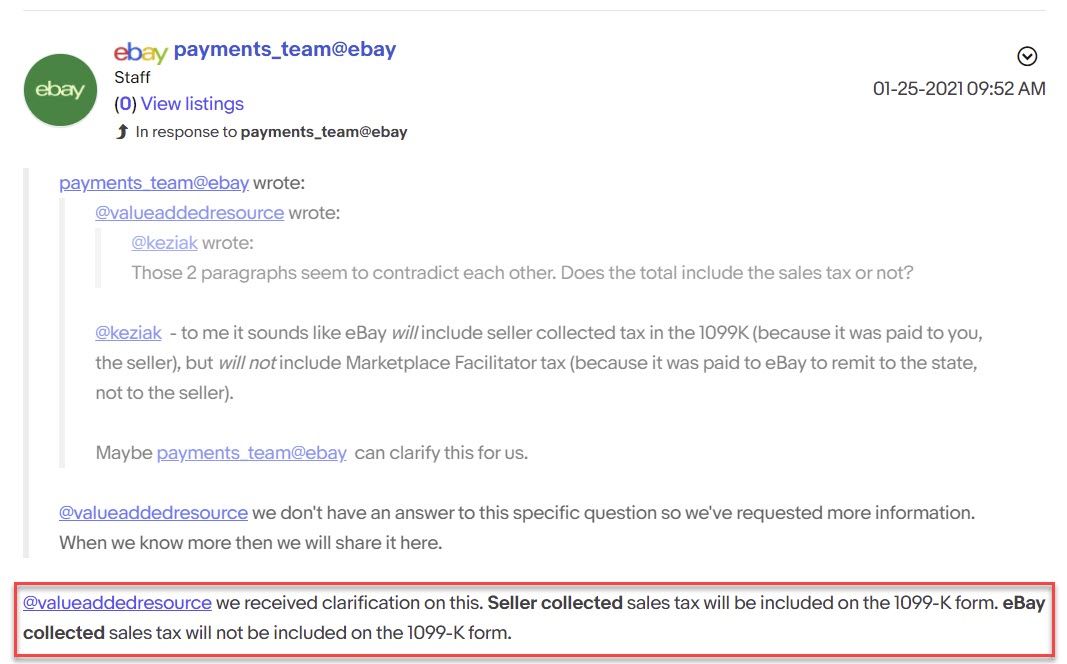

Many Managed Payments sellers were confused earlier this year when eBay issued 1099-K forms for income tax purposes. Previously in PayPal, eBay collected tax was included in the 1099-K figures because that money was paid to the seller.

However, eBay did not include eBay collected tax for the Managed Payments 1099-K and very clearly stated the reason why: eBay collected Marketplace Facilitator sales tax isn't paid to the seller.

I asked the eBay Managed Payments team in the community to confirm this, which they did.

This got me wondering how exactly does the money flow work with Adyen?

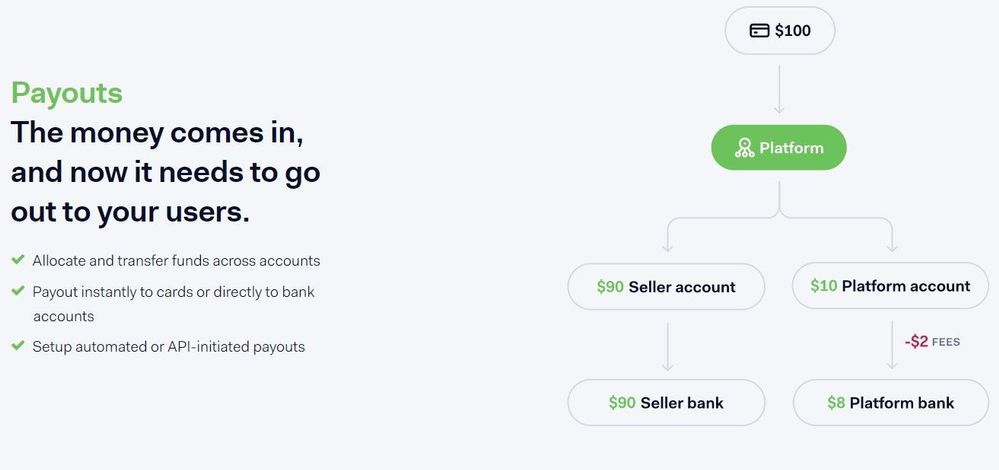

I have no inside information or confirmation, but I'm guessing eBay is likely using a customized version of Adyen's Platform solution.

This is a generic image from Adyen's site, so it may not be an exact representation of eBay's set up, but if the money flows somewhat like this, it could explain why eBay does not include eBay collected Marketplace Facilitator tax in the 1099-K.

In theory, the money could go from the buyer to the Platform (not clear if that is eBay or Adyen), then allocate certain amounts to the Seller account and other amounts (fees and eBay collected taxes) to the Platform account (eBay).

In that scenario, it could be entirely possible that those tax amounts are never paid to or received by the seller, which is what eBay's 1099-K help page clearly says.

So it would appear that eBay thinks they can have their cake and eat it too. They seem to understand that for income tax purposes, they cannot include Marketplace Facilitator taxes in the 1099-K because they are not actually paid to the seller.

However, they also seem to think it's justifiable to include those tax amounts when calculating their fees, even though they've clearly admitted that money never touches the seller's account.

The last few states which had not jumped on board the remote tax wagon have finally passed their own Marketplace Facilitator laws. Florida and Kansas remote sales tax laws will take effect on July 1st, 2021 and Missouri's law will be effective in 2023.

At that point, all 45 states plus the District of Columbia which have a general sales tax in place will require eBay to collect and remit sales tax as a Marketplace Facilitator - meaning 100% of sales tax collected on eBay will be collected by eBay.

I think that raises some very interesting legal and ethical questions, though I'm sure eBay is not terribly inclined to answer them.

Follow Value Added Resource on Twitter & Facebook ✔

Subscribe to receive eBay seller news, tips, and insights in your inbox 📧

Interested in being featured in the Seller Spotlight? Tips, story ideas or guest post recommendations? Contact me here!

Share with friends and leave a comment 👇