Received An eBay 1099-K But Never Sold On The Platform?

UPDATE 1-18-23

As 1099-K forms for tax year 2022 start mailing out this month, reports of accounts using stolen identities may start to pop up again.

If you receive a 1099-K from eBay for an account you did not knowingly create or use, I want to hear from you!

Requests for confidentiality will absolutely be respected.

Message me on Twitter @ValueAddedRS and Facebook @ValueAddedResource or email me at liz@valueaddedresource.net

UPDATE 4-18-22

Today is tax day, so it seemed an appropriate time for an update. After 2 months of research, I can confidently say stolen personal identity information is being used to create fraudulent accounts to sell on eBay and eBay's Trust & Safety and Managed Payments departments did not catch them despite Know Your Customer (KYC) and anti-money laundering verification requirements.

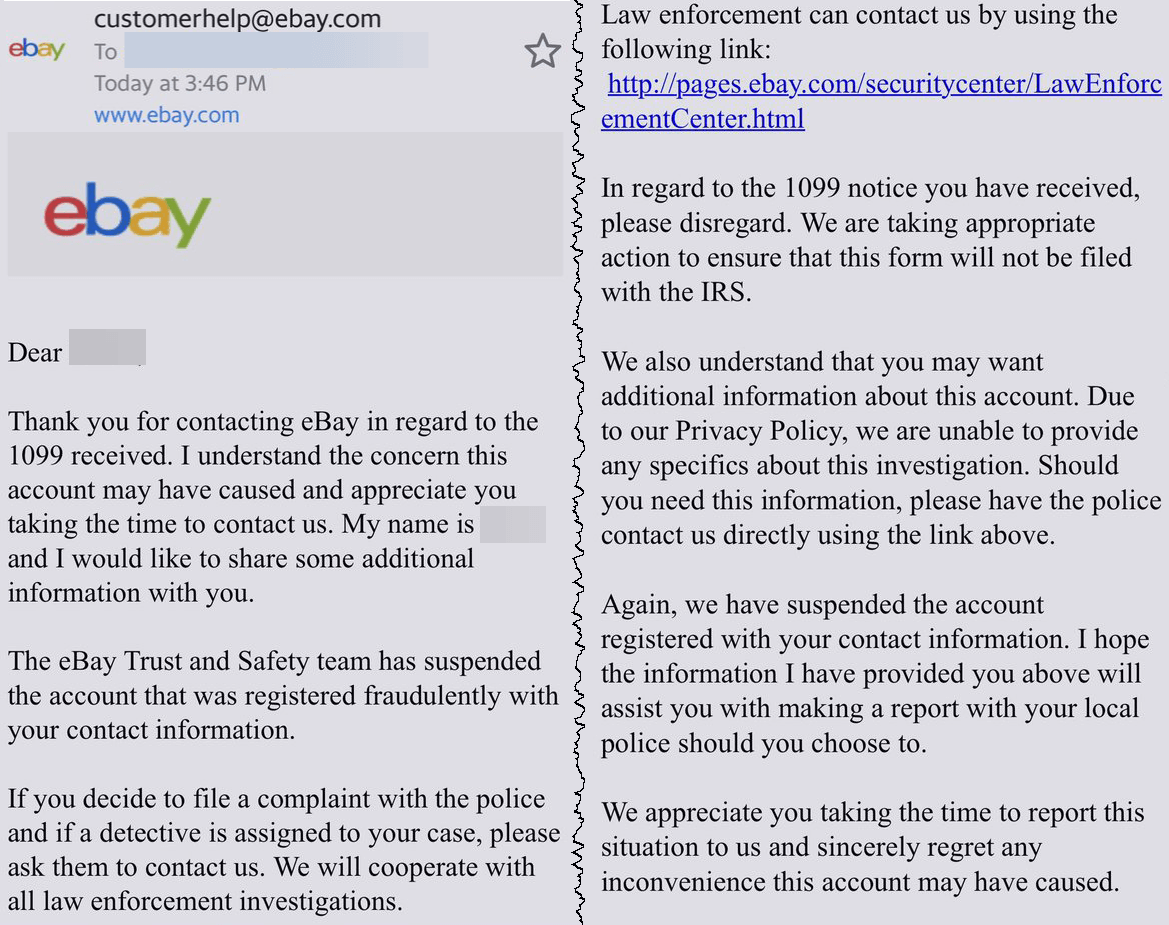

eBay support did finally receive the boilerplate responses from the legal department to forward to affected victims - acknowledging that these accounts were fraudulent, but then putting all the responsibility on the identity theft victim to pursue the matter with law enforcement.

Multiple victims forwarded me screenshots of the response from eBay and they were all exactly the same.

While eBay told victims who contacted them that the forms would not be sent to the IRS, many are still concerned this fraudulent information could cause an audit or other problems for them.

And what about victims who were not able to contact eBay support? If an account wasn't reported to them and shut down by Trust & Safety, presumably the 1099-K may still have been sent to the IRS.

I collected information from 76 individual reports either publicly across social media and the eBay community or privately through email or messages. I fully believe this is just a very small drop in the bucket, however, here's what I was able to glean from those reports.

Financial scope - 41/76 reports mentioned dollar amounts from the 1099K - total ~ $750,000 with the highest one reported at $180,000. Out of the 41 with dollar amounts, 26 of them were $10,000 or above.

These fraudulent accounts were doing significant high volume/high dollar sales for months without being flagged or caught by eBay.

SSN: 16 said the last 4 digits of the social security number does not match theirs, 12 say it does match, 48 did not answer.

Names: Most names match, with the exception of 3 that had the correct first name but a maiden name or last name from a previous marriage that has changed.

Addresses: Most addresses match, 2 were old addresses (mail forwarded), and 2 were partial address matches where either an apartment number was missing or had been added.

Several reports also indicated they had received returned items at their addresses, likely due to their address also being used for the default return address on these fraudulent accounts.

Fraudulent eBay ID: I verified 16 of the account IDs that were not recognized by the receiver of the 1099K.

All 16 accounts fit the common pattern eBay uses when automatically generating a user ID for a new account (typically a few letters from first name, a few letters from last name and some numbers).

The oldest of those accounts was created in February 2020 and was still very active with over 6,000 listings (eBay finally shut this account down a month after the receiver of the fraudulent 1099-K reported it).

The accounts were selling a variety of items, but print on demand products like t-shirts and coffee mugs appeared to be the most popular.

Reports have fallen off for now, however I expect we may see more bubble up if some of these victims do start to get audited.

Of course, I also expect we'll see a spike of reports happen in January/February 2023 - unless of course eBay finally decides to get serious about proactively addressing account security, verification, and rampant fraud on the platform.

UPDATE 2-21-22

I'm continuing to investigate and document more reports as they come in as well as eBay's response (or lack thereof) - stay tuned for results!

Thanks to WebRetailer and eSeller365 for helping me get the word out!

UPDATE 2-12-22

As of today, I've collected 54 reports across social media, eBay community, and people who have reached out directly. All of these reports say the account ID listed on the 1099-K form from eBay is not theirs and many of them say they've never knowingly created an eBay account for either buying or selling.

Here's what I have found so far:

Financial scope - 22 reports mentioned dollar amounts from the 1099K - total so far about $300K with the highest one reported at $46k

SSN: 16 say the last 4 digits of the social security number does not match theirs, 8 say it does match.

Names: Most names match, with the exception of 3 that had the correct first name but a maiden name or last name from a previous marriage that has changed.

Addresses: Most addresses match, 2 were old addresses (mail forwarded), and 2 were partial address matches where either an apartment number was missing or had been added.

I've also verified 8 of the account IDs that were not recognized by the receiver of the 1099K. The oldest of those 8 accounts was created in February 2020 and is still very active with over 6,000 listings.

eBay's support response has been mixed - most people I've spoken to have been told this was just an error and the 1099-K can simply be disregarded, others have said they were advised by eBay support to report the matter to the IRS, credit bureaus and law enforcement as possible identity theft.

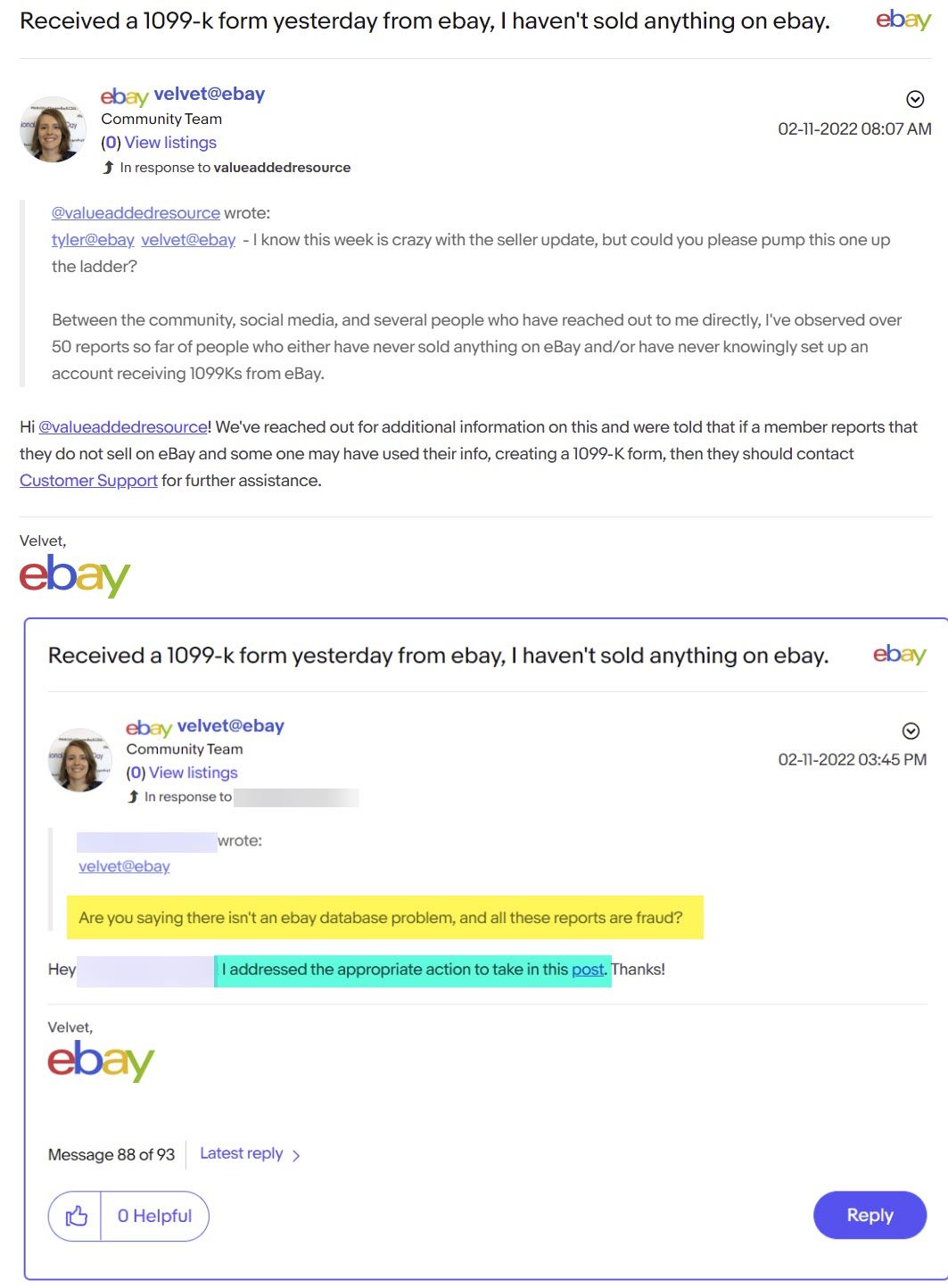

Publicly, eBay community staff are simply directing people to contact support and have had no comment when pressed for additional information.

UPDATE 2-9-22

Thanks to Brian Krebs for sharing this & welcome to all the new readers that have stopped by!

Some people are receiving 1099-K tax forms from eBay, even though they don't even have eBay accounts or didn't sell anything on eBay. Triangulation fraud? Something else? @ValueAddedRS investigates: https://t.co/XnCtz1pOT3

— briankrebs (@briankrebs) February 9, 2022

I've so far seen ~ 35 reports either in the eBay community, across social media or privately emailed to me.

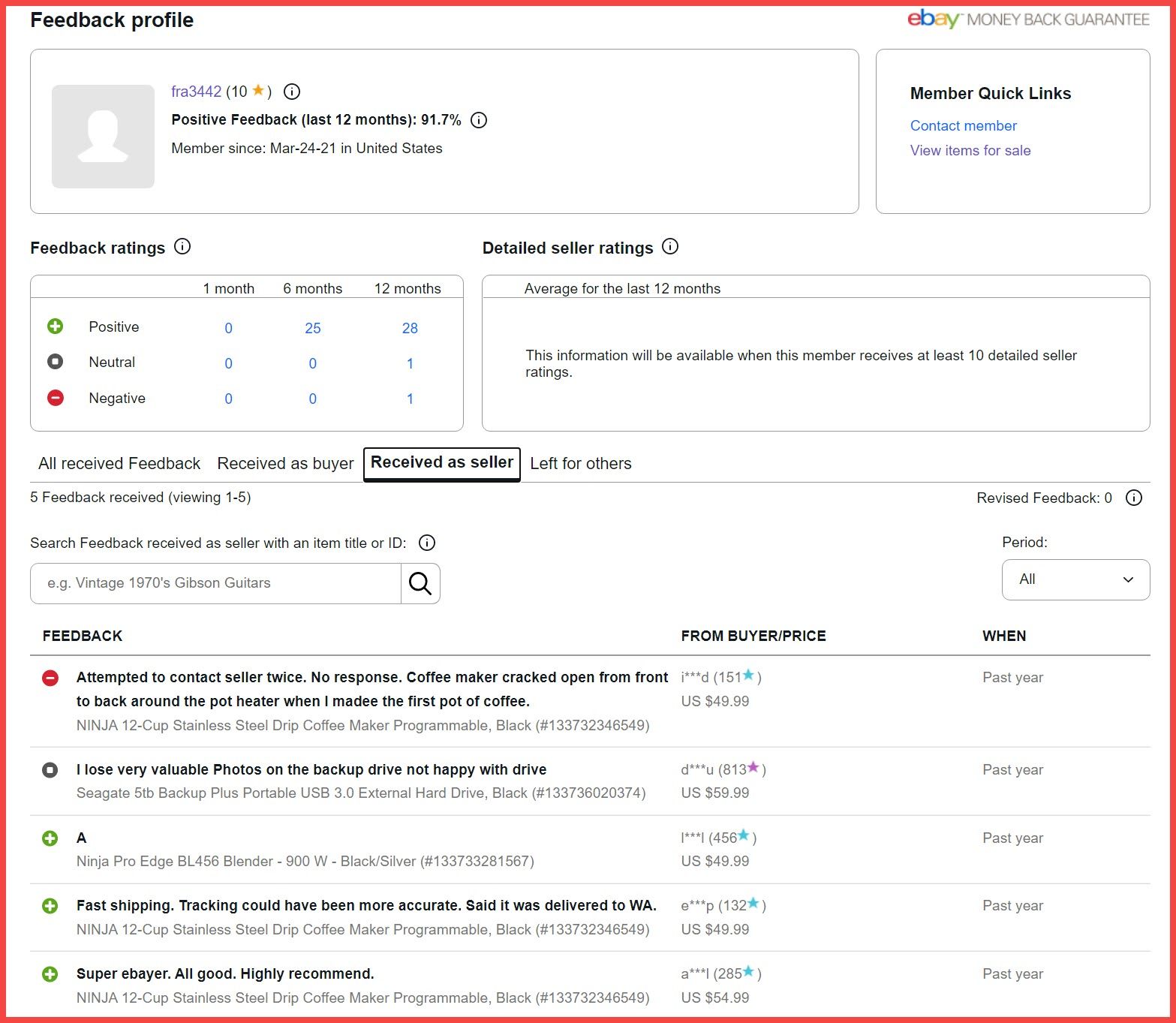

I've also been able to verify 2 of the suspected fraudulent accounts that were attached to 1099-K forms where the receiver did not set up the account and can confirm there are several red flags that these accounts were/are being used to commit fraud on the platform

One example:

Many affected users are reporting eBay support is advising them this was an "error" and they can simply disregard it and throw the 1099-K away - which is absolutely terrible advice.

Regardless of whether or not this form is sent to the IRS, I would advise anyone affected to report it the IRS, credit agencies, and any relevant law enforcement agencies as identity theft and fraud.

Beyond that, it is very troubling to hear that eBay is apparently sidestepping the issue, calling it an "error" instead of being upfront about what is really going on.

This looks to be a very serious security issue in the making - eBay needs to get out ahead of it with transparency, openness and honesty that CEO Jamie Iannone says drives their success.

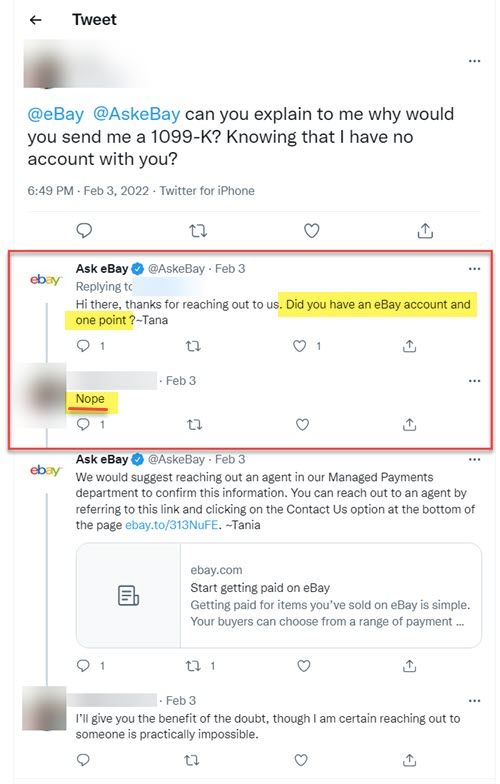

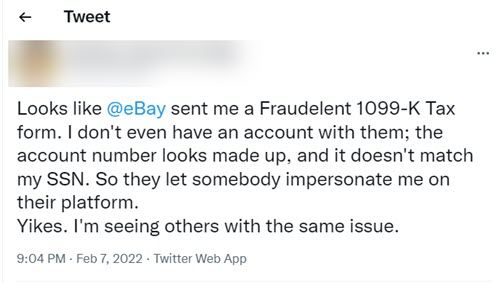

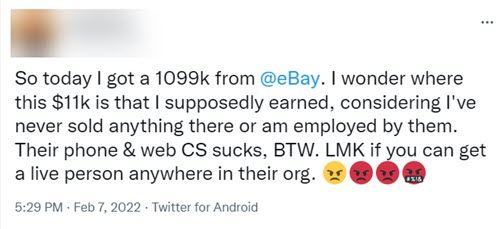

It's been a rough month so far for eBay's VP of Tax Carol Tabrizi with multiple 1099-K errors reported, but now I'm seeing something even more concerning - reports from people who say they received a 1099-K from eBay despite never having sold anything on the platform.

Some users say they've never even had an eBay account!

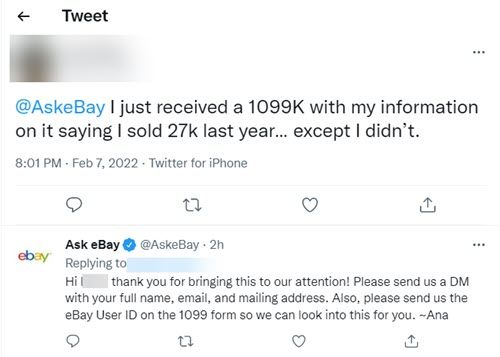

Another Twitter user reported receiving a 1099-K from eBay for over $31,000 but states someone else is using their name and address to sell items.

There are multiple reports in the eBay community as well, with some users creating accounts specifically just to post about this issue.

Yesterday I received a 1099-k form from ebay, the only problem is I have never sold any items on ebay.

On the form it says for both the month of june and july of 2021 it says the gross amount of payment/third party network transactions was $822.48.

Again I have never sold nor listed anything for sale on ebay before. I checked my transactions for those two months and I made four purchases that totaled $360. So I am not sure why I am getting this form. Is this a scam?...

Other community members suggested for the original poster to check to see if the eBay user ID and social security number on the form matched their own.

They responded:

No that box doesn't have my seller ID it is someone else's...

...It is my name and address but if by SS# you mean the payee's tin number than no it is not the last four of my SS#.

Other users chimed in on that thread to report they too had received a 1099-K despite not selling anything.

This happened to me today! I do not have an eBay account and have never sold anything and it says all the transactions happened in September. It’s my name and actually an old address, but not last 4 of social or account name. Did you get a reply from eBay?

I also got a 1099-K today and I also have never sold anything at all on eBay. Never.

"Payee's TIN" does not match my SSN.An account number is shown, but I was not aware of even having an account on eBay at all (except for the one I created today in order to pursue this issue).

I'm shown as receiving $1,976 in June (nothing for rest of year), and the number of transactions is shown as 21.

Again, I have never sold or bought anything on eBay.

This one was most concerning - the user says they had an old eBay account that was hacked over 2 years ago.

I got a similar 1099-K today. Wrong TIN, address has an apartment number (I have no apartment), my old account was hacked about 2 1/2 years ago and had to close the account and get a new e-bay name.

The ransomware/hack turned my email address into a spam bot and thus had to change my email address. That old email address was frozen then closed. This may have been part of the huge hack that Facebook got caught in. I don't even use FB, but the hack somehow found me and my contacts E-Bay has a BIG problem with this, I bet.

So, my issue is even worse because they sent someone else's 1099 K to my husband with his name and someone else's TIN/SSN! This person has over $14,000 in sales and my husband has not sold anything on eBay in years.

This is happening to me too. I received someone else's 1099-K form in the mail with someone else's transaction info and my name/address/ssn, but with the other person's ebay account number. And when I go to the electronic 1099-K form under my account, it says there's no 1099-K form for me because my transactions don't require one!

I've also found one report on JustAnswer.com

And another at PissedConsumer.com

So what's going on here? It's hard to say for sure but it would seem at the very least there may be an issue where eBay has mixed up user info and sent 1099-Ks meant for someone else to some users.

Another possible explanation could be that bad actors on the platform may have supplied stolen Personal Identifiable Information (PII) to eBay for the purposes of engaging in fraud.

I've spent the last two years tracking sophisticated triangulation fraud that uses hijacked compromised eBay accounts to sell essentially stolen goods.

eBay also has a huge ongoing problem with compromised accounts being used for other types of fraud, like these car scams where the fraudsters attempt to get the unwitting buyer to make payment off the platform.

Or this report from the UK where a hacked account was used to sell expensive trading cards, Rolex watches, and carbon fiber bicycles.

It would not at all be a stretch of the imagination to think that sophisticated fraudsters operating on the platform with access to a large amount of compromised account credentials and/or stolen credit cards could also be using stolen identity information as well.

While the exact details are not clear yet, it's likely there is some form of fraud being perpetrated using these accounts.

If you have received a 1099-K from eBay with someone else's tax information, first report it to eBay's Payments department and most importantly Trust & Safety.

You'll also want to contact the IRS to report possibly fraudulent tax information - even if they are using a different social security number, this information could be linked to your personal information, so it's better to err on the side of caution.

Here are some additional resources regarding tax related identity theft.

Beyond that, eBay must get a handle on these rampant fraud and account security issues - including absolute transparency and disclosure of any hacking or breaches that may have occurred.

If eBay wants all of the financial benefits that come from managing payments, they must absolutely be responsible and accountable for the safety and security of the entire payments process including personal identifiable information required as part of Know Your Customer (KYC) rules and regulations and tax requirements.

If eBay cannot or will not take that responsibility seriously, maybe it's time for the Federal Trade Commission and Consumer Financial Protection Bureau to fire a warning shot across the bow to get their attention.

Value Added Resource is proudly reader supported - learn more about our commitment to 100% ad-free, independent journalism.

eBay seller since 2022

Just started selling about a year and half ago

800 items sold 99.7 feedback

Recently I went away for family things for 30 days set my acct to be away … got back with items not received cases opened

I wasn’t able to revise existing listings post new listings OR refund the buyer from my eBay funds …

The items were caught up in recent wild fires but ended up being delivered late. I had to beg the buyer to let me pay them off of eBay to close the case because it was on hold and I wasn’t able to refund them from my eBay acct etc…. So luckily they obliged and I did … but ever since then my acct must be strikes as high risk because funds have been on hold 3 days after delivery since then indefinitely might I add… I get the run around everytime etc etc FINALLY I got someone saying it’s temporary it’ll be back to normal etc. these r all reps from escalated departments… one lady told me that with my history and feedback I’ve proved beyond doubt that I’m reliable seller and shouldn’t be on hold she put in for a appeal never heard back got the run around for another few months… they keep telling me I’ve been chosen for the new update they r rolling out total BS … do you believe that sellers will stay on eBay with these holds ? No they will simply go to another platform … they r 100% making money on the holds and use any reasoning to tell you basically no and keep profiting…. The get around is creating a new acct… these cases were closed without eBay having to step in and might I add I lost $$ and its been truly frustrating esp since I’ve built the acct up but I know I can do it again.. when they tell me its going to happen to all accts I just mention how my brother just opened one n now has immediate payments they don’t know what to say I don’t think they really even know.,, its sad n scummy but I see a class action lawsuit coming honestly ! I don’t know💬 if I forgot anything but well written thanks for the information. Have a great one!