Corporate Transparency Act Beneficial Ownership Reporting: What Online Businesses Need To Know

Heads up online sellers - the Corporate Transparency Act Beneficial Ownership Reporting requirements go into effect January 1, 2024, which may require you to register and report important information about your business to the U.S. Department of the Treasury.

In 2021, Congress enacted the Corporate Transparency Act, creating a beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

New Federal Reporting Requirement for Beneficial Ownership Information (BOI)

Beginning on January 1, 2024, many companies in the United States will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the company. They will have to report the information to the Financial Crimes Enforcement Network (FinCEN). FinCEN is a bureau of the U.S. Department of the Treasury.Who Has to Report?

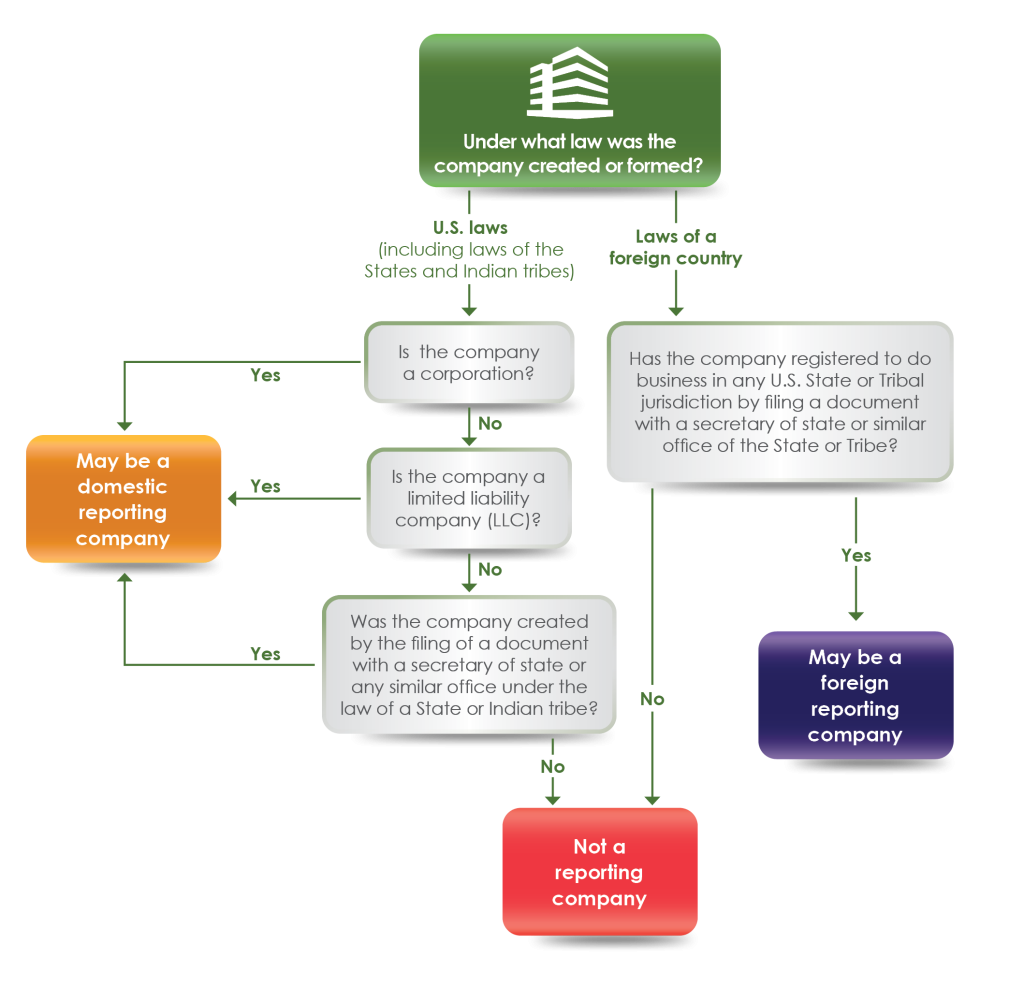

Companies required to report are called reporting companies. Reporting companies may have to obtain information from their beneficial owners and report that information to FinCEN.Your company may be a reporting company and need to report information about its beneficial owners if your company is:

- A corporation, a limited liability company (LLC), or was otherwise

created in the United States by filing a document with a secretary of

state or any similar office under the law of a state or Indian tribe ; or- A foreign company and was registered to do business in any U.S.

state or Indian tribe by such a filing.

Companies which are required to report Beneficial Ownership Information will have to provide name, date of birth, residential address and government ID for any individual who either directly or indirectly: exercises substantial control over the reporting company, or owns or controls at least 25% of the reporting company’s ownership interests (see FinCEN FAQ for further definitions).

What information will a reporting company have to report about itself?

A reporting company will have to report:

- Its legal name;

- Any trade names, “doing business as” (d/b/a), or “trading as” (t/a) names;

- The current street address of its principal place of business if that address is in the United States (for example, a U.S. reporting company’s headquarters), or, for reporting companies whose principal place of business is outside the United States, the current address from which the company conducts business in the United States (for example, a foreign reporting company’s U.S. headquarters);

- Its jurisdiction of formation or registration; and

- Its Taxpayer Identification Number (or, if a foreign reporting company has not been issued a TIN, a tax identification number issued by a foreign jurisdiction and the name of the jurisdiction).

A reporting company will also have to indicate whether it is filing an initial report, or a correction or an update of a prior report.

What information will a reporting company have to report about its beneficial owners?

For each individual who is a beneficial owner, a reporting company will have to provide:

- The individual’s name;

- Date of birth;

- Residential address; and

- An identifying number from an acceptable identification document such as a passport or U.S. driver’s license, and the name of the issuing state or jurisdiction of identification document (for examples of acceptable identification, see Question F.5).

The reporting company will also have to report an image of the identification document used to obtain the identifying number in item 4.

Reporting companies will have to report beneficial ownership information electronically through FinCEN’s website: www.fincen.gov/boi starting on January 1, 2024.

- If your company was created or registered prior to January 1, 2024, you will have until January 1, 2025, to report BOI.

- If your company was created or registered on or after January 1, 2024, and before January 1, 2025, you must report BOI within 90 calendar days after receiving actual or public notice that your company’s creation or registration is effective, whichever is earlier.

- If your company was created or registered on or after January 1, 2025, you must file BOI within 30 calendar days after receiving actual or public notice that itscreation or registration is effective.

- Any updates or corrections to beneficial ownership information that you previously filed with FinCEN must be submitted within 30 days.

Exemptions

There are 23 types of entities which are exempt from the beneficial ownership information reporting requirements, including publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

- Securities reporting issuer

- Governmental authority

- Bank

- Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment company or investment adviser

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity

- Entity assisting a tax-exempt entity

- Large operating company

- Subsidiary of certain exempt entities

- Inactive entity

Check the FinCEN Small Entity Compliance Guide for a checklist to help determine if you qualify for any of these exemptions.

What about Sole Proprietors?

If you operate your online business as a sole proprietor, you may not be required to report Beneficial Ownership Information - depending on whether or not your state requires sole proprietors to file a document with the Secretary of State in order to form a business.

Filing with a government agency to obtain an EIN from the IRS, register a fictitious business name, or apply for a professional or occupational license does not qualify as these actions typically do not create a new business entity that would be classified as a reporting company.

Is a sole proprietorship a reporting company?

No, unless a sole proprietorship was created (or, if a foreign sole proprietorship, registered to do business) in the United States by filing a document with a secretary of state or similar office.

An entity is a reporting company only if it was created (or, if a foreign company, registered to do business) in the United States by filing such a document.

Filing a document with a government agency to obtain (1) an IRS employer identification number, (2) a fictitious business name, or (3) a professional or occupational license does not create a new entity, and therefore does not make a sole proprietorship filing such a document a reporting company.

For questions about how this new reporting requirement will impact your specific business, contact FinCEN directly or consult with a qualified accounting or tax professional who is familiar with the business entity creation and reporting requirements of your state.